How to Evaluate Virtual Care for Pharma Brands

In the past, pharma commercialization meant getting a medicine to market and getting it covered. But that playbook is no longer enough. Today’s healthcare consumers expect more, and they’re taking more control of their care journeys than ever before. Whether it’s a patient researching treatment options online or comparison shopping for prescriptions, traditional pathways like the “ask your doctor” model are falling short of consumer expectations.

This shift isn’t just about patient behavior. It’s reshaping the way life sciences brands go to market and raising a critical question: Should virtual care be part of your commercialization strategy?

For many brand, access, and digital leaders, this question is becoming harder to ignore. Virtual care is no longer a future-state aspiration. It's a strategic channel that, when matched appropriately to the brand, can accelerate speed-to-therapy, expand access, and deepen long-term patient relationships. That said, not every therapy is a fit for virtual care. The challenge is knowing where it makes sense, and learning how to evaluate the opportunity without defaulting to shiny-object thinking or point-solution chaos.

Introducing the virtual care fit guide framework

To help teams navigate this evaluation, Wheel developed a structured decision-making tool called the Virtual Care Fit Guide. Built for life science leaders across commercialization, market access, and digital innovation, it offers a practical self-assessment to help determine whether a therapy and its associated patient journey is well suited for a virtual-first model.

The framework breaks fit down into four dimensions:

- Treatment protocol – Is the therapy episodic or longitudinal? Can prescribing and monitoring happen virtually, or are in-person interventions required?

- Diagnosis complexity – Can this condition be safely diagnosed based on symptoms, visuals, or patient history without requiring a physical exam?

- Care model – Does care involve a single touchpoint, or does it require ongoing engagement, symptom tracking, or dose titration?

- Patient population – Is this a digitally engaged group? Do they face access delays, stigma, or provider shortages?

These criteria help anchor internal conversations in the real operational and clinical requirements of virtual care, rather than starting from a solution and working backward.

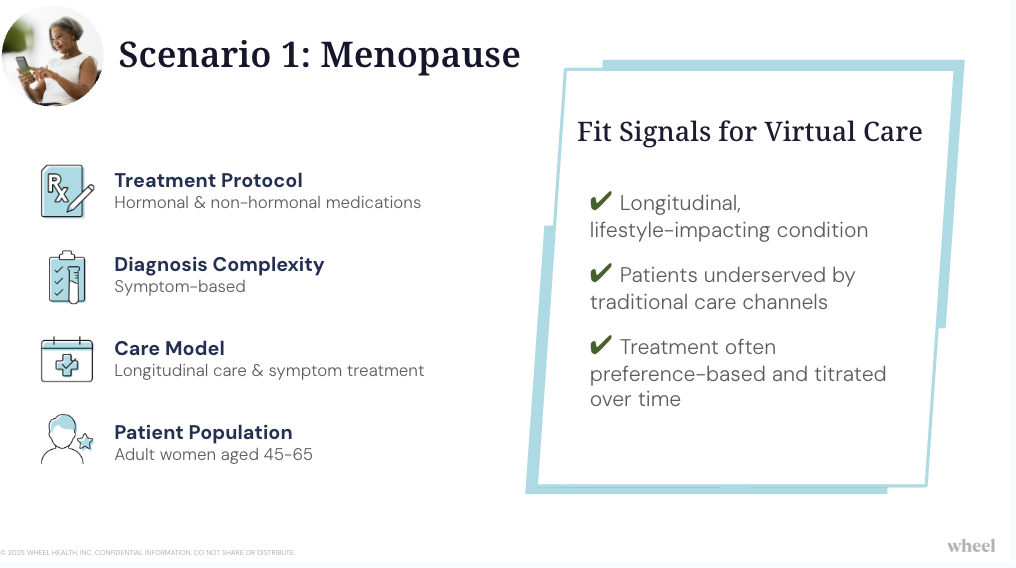

A real-world DTC telehealth application: Menopause use case

Let's explore an example scenario to bring this framework to life.

Therapeutic scenario:

A pharmaceutical company has multiple brands that support the treatment of common menopause symptoms including hot flashes, mood swings, and vaginal health. The company is looking to maximize their commercialization spend by packaging the various brands into a single patient experience to support women throughout the menopause transition. The goal is to move from disconnected DTC efforts to a longitudinal experience that can educate, triage, and treat.

Evaluation criteria:

- Treatment protocol – Hormonal & non-hormonal medications

- Diagnosis complexity – Symptom-based diagnosis

- Care model – Longitudinal care & symptom treatment

- Patient population – Adult women aged 45-65; underserved population

Using this framework, the fit is clear. The patient population—women aged 45 to 65—are digitally savvy but often underserved by traditional care channels. Diagnosis is symptom-based and does not require labs or physical exams. Treatments are standardized but often need dose titration over time. And the care model is inherently longitudinal, evolving with the patient’s symptoms and lifestyle.

In other words, this isn’t just a digital add-on. It’s a strong candidate for a virtual-first, continuous care program, with clear value across access, engagement, and brand performance.

Business value of virtual care in pharma

Menopause is a longitudinal, preference-sensitive condition with wide-ranging symptoms: hot flashes, sleep disruption, weight gain, mood changes, vaginal dryness. Many women navigate this transition without clinical support, in part because there’s a lack of trained specialists, and stigma still plays a role.

This is where virtual care can step in by offering:

- Immediate access to trained providers who specialize in menopause care

- A structured clinical model for initial intake, HRT or non-hormonal treatment, and ongoing follow-ups

- Support for symptoms that change over time without asking patients to constantly re-explain themselves

- A comfortable, stigma-free setting that encourages engagement

This isn’t just a symptom-check and script model. It’s a full, continuity-of-care experience delivered in a scalable, digital format.

From a commercialization standpoint, this model can:

- Increase adherence by maintaining consistent, personalized care

- Extend brand loyalty beyond LOE, especially in cash-pay scenarios

- Unlock new DTC activation channels by meeting women at the moment of search

- Provide ongoing real-world outcomes data across symptom domains

The key message here: virtual care isn’t just about access. It’s about building lasting patient relationships that drive brand value and health outcomes.

It's a compelling example because menopause is not rare or niche. It's a mainstream, high-demand condition where care gaps persist and where virtual infrastructure can meaningfully close them. Yet it also illustrates the type of complexity that must be evaluated intentionally, because virtual care done poorly can compromise trust or compliance. Fit isn’t about marketing potential. It’s about clinical safety, operational readiness, and business value.

When virtual care doesn't fit

Of course, not every scenario is as straightforward as the menopause example. In the Virtual Care Fit Guide, we evaluate a rare disease scenario that requires an in-person procedure and testing to confirm diagnosis. For this example, virtual care is not appropriate for initiation. But the evaluation reveals value elsewhere: refill management, symptom check-ins, and structured post-diagnosis support.

This distinction is important. Fit isn’t binary—it’s about identifying where virtual care adds value in the broader journey. That might be through awareness campaigns, virtual screening tools, or longitudinal adherence programs that kick in after in-person diagnosis.

Strategic importance of direct-to-consumer care in pharma

As the regulatory environment grows more complex, and scrutiny increases around DTC and digital channels, many pharma leaders are justifiably cautious. But caution doesn’t mean avoidance. It means approaching virtual care the way any other strategic investment is approached—with rigor, discipline, and a clear framework for decision-making.

The opportunity cost of waiting is real. Across Wheel-powered programs, life sciences brands have launched virtual care programs in under 60 days, gained market share, and reached patients sooner than traditional commercialization models. These commercialization accelerants can define a brand’s performance window during its most critical years.

But that only happens when virtual care is used with precision. And that precision starts with a smart evaluation process.

A smarter way to evaluate digital health programs for pharma

If your team is exploring virtual care as part of a brand launch, portfolio expansion, or LOE retention strategy, the question isn’t just can we? It’s should we? And if so, how?

This virtual care evaluation tool was built to help you answer that question. It walks through clinical, patient, and operational dimensions of fit, provides real-world therapeutic scenarios for comparison, and lays out the steps for aligning your team around a go-forward strategy.

If you're ready to move past theory and toward impact, now’s the time to take stock and take action.