How to Reduce Virtual Care Delivery Costs and OPEX

Delivering virtual care at scale is extremely capital intensive. In today’s uncertain economic climate, it’s more critical than ever that companies optimize their virtual care delivery model to mitigate financial risk and stay competitive.

Decreasing operating expenses is one of the most effective ways for a company to prepare for an economic downturn. But healthcare is different from other industries. Choosing the wrong expense or role to cut could do more than harm the business — it could compromise the health and safety of patients.

So how can healthcare companies offset OPEX while maintaining the high-quality clinical services patients know and love? And should they consider reducing or scaling back their services?

Neither is a good option, but luckily there are strategies to keep your roadmap on track and scale responsibly.

In this article we’ll:

Review the primary costs involved in telehealth delivery

Reveal hidden expenses that emerge with scale

Address the economic tradeoffs for various cost savings approaches

We’ll also share a critical shift to your care delivery model that offers the greatest economic advantage for companies at any scale and illustrate how a leading digital health company has instituted this change — resulting in a 67% reduction in OPEX!

Understanding Operating Expenses in Telehealth

Major costs in telehealth delivery

Digital health is different from e-commerce or businesses with physical inventory — the biggest operating expense in telehealth typically comes down to headcount.

Here’s an overview of the primary cost categories involved in virtual care delivery:

HQ employee salaries and administrative costs

Clinician staffing and management overhead

Medical operations

Technology and platform expenses

Marketing and patient acquisition costs

Legal and regulatory costs

Costs of in-house clinical staffing for telehealth

Clinician staffing accounts for a large portion of OPEX for companies delivering virtual care. Let’s break down these expenses to understand why.

1. Clinical workforce costs (bulk of costs)

Clinical workforce costs make up the bulk of clinician staffing expenses. This includes clinician salaries, clinician management costs, regulatory costs, and the costs of medical operations.

Clinician salaries. Many companies hire clinicians on a full- or part-time basis, ensuring a guaranteed compensation. This presents challenges when patient demand doesn’t precisely match the makeup of the clinical network, as clinicians can sit idle, a sunk cost, or patients incur high wait times without an available clinician to take the visit, an opportunity cost. You can read more about the economics of matching patient demand with workforce supply here.

Clinician management costs and resources. This category includes scheduling, clinical recruitment, and support services and is rife with hidden costs at scale. We’ll dive into this below.

2. Regulatory costs

To legally deliver professional virtual care services, companies must engage legal counsel to form a “Friendly PC” structure. This can take 1.5-2 years to build out and cost hundreds of thousands in legal fees.

3. Medical operations costs

From hiring a medical director and/or PC-owner licensed in multiple states, to building guidelines, procedures, and protocols for treatment modalities, this category is essential to delivering high-quality telehealth services and is a non-negotiable area to slash. Companies also must build programs to train and onboard new clinicians while implementing ongoing quality review processes.

Hidden Costs in Telehealth Delivery

Not all telehealth delivery costs are obvious. Here’s where companies often hit economic challenges as they scale.

Precision staffing

Many companies don’t anticipate the massive overhead and complexity involved in scheduling clinical staff for telehealth services — particularly at large geographic scale. The first step is ensuring coverage in all states, but layered on top are operating hours across time zones and patient demand forecasting by geography (nearly impossible to predict!).

In addition, companies must navigate state-by-state independent contractor employment laws while balancing variations in scope of practice across states based on the clinician license type.

Clinical recruitment

While this cost category may not truly be ‘hidden’ based on the clinician shortage, the challenge at scale comes with clinician attrition.

As clinicians leave the company for other opportunities, companies can be faced with a logistical and recruitment nightmare (READ: costs) to try and replace the specific licenses needed for patient coverage.

Clinician support services

As the number of internal clinicians grows, the internal resources required to support this workforce also increase. Clinical networks require dedicated support teams at the ready.

Staff members initially needed to develop clinician onboarding programs must routinely conduct these trainings on a more frequent basis.

Licensing and credentialing teams, internal or outsourced, are needed to manage the team.

And readily available technical support, clinical guidance, and general clinician management support are now table stakes to keep a workforce happy and committed.

Quality assurance management

With only a handful of in-house clinicians, quality care can be relatively easy to monitor. But as the workforce grows and services potentially expand, managing a quality assurance program becomes increasingly burdensome.

Charts should be regularly audited for quality assurance

Performance should be tracked across various benchmarks

Processes should be built and instituted for conducting clinician training and interventions

Thorough quality assurance programs require significant resources to maintain and manage.

Traditional Options for Cutting Telehealth Service Costs

Here’s what companies have historically considered when slashing expenses.

People. Cutting internal staffing and stretching existing resources thin. IMPACT-> Not ideal in a healthcare services setting as patient or clinician support services can be compromised.

Services. Cutting the most expensive services and/or services with lower ROI, or deprioritizing service lines. IMPACT-> Detrimental to the patient experience as expected services are suddenly no longer available.

Growth plans. Freezing geographic expansion, delaying new service launches in specific states, or holding back on aggressive marketing campaigns. IMPACT-> Leaves the door open for competitors to capture patient demand and build brand loyalty.

Product roadmaps. Delaying new product features and adjusting the product roadmap. IMPACT-> Patient experience stalls as technology advances and consumers come to expect certain features.

What’s the overall result of making these cuts?

Lost revenue

Lost opportunities

Perhaps most damaging -> losing ground to competitors

How Companies Can Successfully Reduce OPEX for Virtual Care

Thankfully, there is a way for virtually care companies to stay fiscally lean, maintain care quality, and keep their competitive advantage.

The critical solution for companies looking to lower operating costs requires transitioning from a pay-per-clinician model of staffing to paying-per-consult.

Pay-per-clinician models require a fixed cost. If you have a clinician on staff in a given state, you pay for their time during business hours, regardless of whether they are seeing patients. And often the flow of patients is not steady, nor predictable.

Pay-per-consult models provide the opportunity to pay a variable cost, meaning you only pay for the clinicians you need when patient demand requests them.

Unless your business already has the power of a 50-state clinical network at hand, it’s impossible to achieve variable cost staffing without leveraging an outside clinician network.

Stop paying for clinicians. Instead, pay for the care.

How outsourcing transitions costs from fixed to variable

Thanks to record-breaking years of growth, the digital health market has reached a tipping point where companies no longer have to build everything from scratch. This rise of healthcare infrastructure players offers a new way to innovate: outsourcing parts of your clinician network instead of allocating the resources to build it in-house.

For virtual care companies, this unlocks the ability to augment your existing clinical network with a network that flexes with demand.

Benefits of outsourcing:

Save money on OPEX with per-consult pricing

Leverage a service that includes workforce management and free up resources for other areas of your business

Leverage tech-enabled load balancing

Achieve savings at any scale (when you chose the right partner)

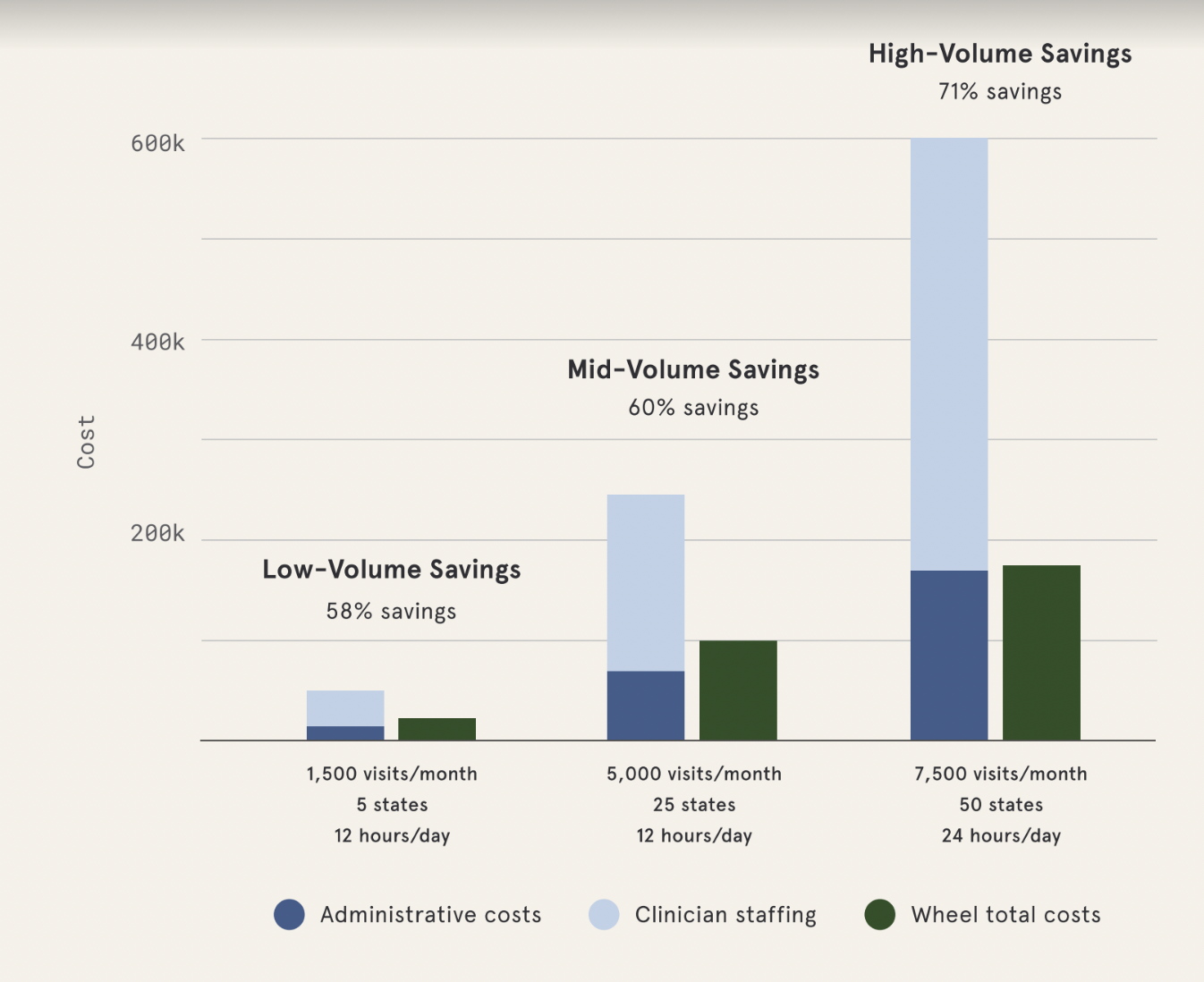

Costs of Running a Clinical Network, In-House vs. With Wheel

Built-in workforce management keeps your costs low and flexes with your demand in real-time. And savings only get better as you scale.

How to outsource responsibly?

A robust clinical network and a high bar for quality will be key differentiators to look out for in this market, along with scalability. Companies must be sure to choose the right partner to ensure quality and the clinician experience are maintained.

Evaluate whether the partner offers...

Proven and guaranteed 50-state coverage

Short SLAs (patient wait times)

An in-house legal team for compliant care

A solid tech platform/infrastructure with flexible APIs

Experienced in-house clinical leadership

A robust quality assurance program with evidence of impact

A scalable / cost-effective pricing model

Case Study: How a Leading Digital Health Company Cut OPEX 67%

Download full case study here.

Here’s how this solution worked for a digital health company working with Wheel.

The Challenge

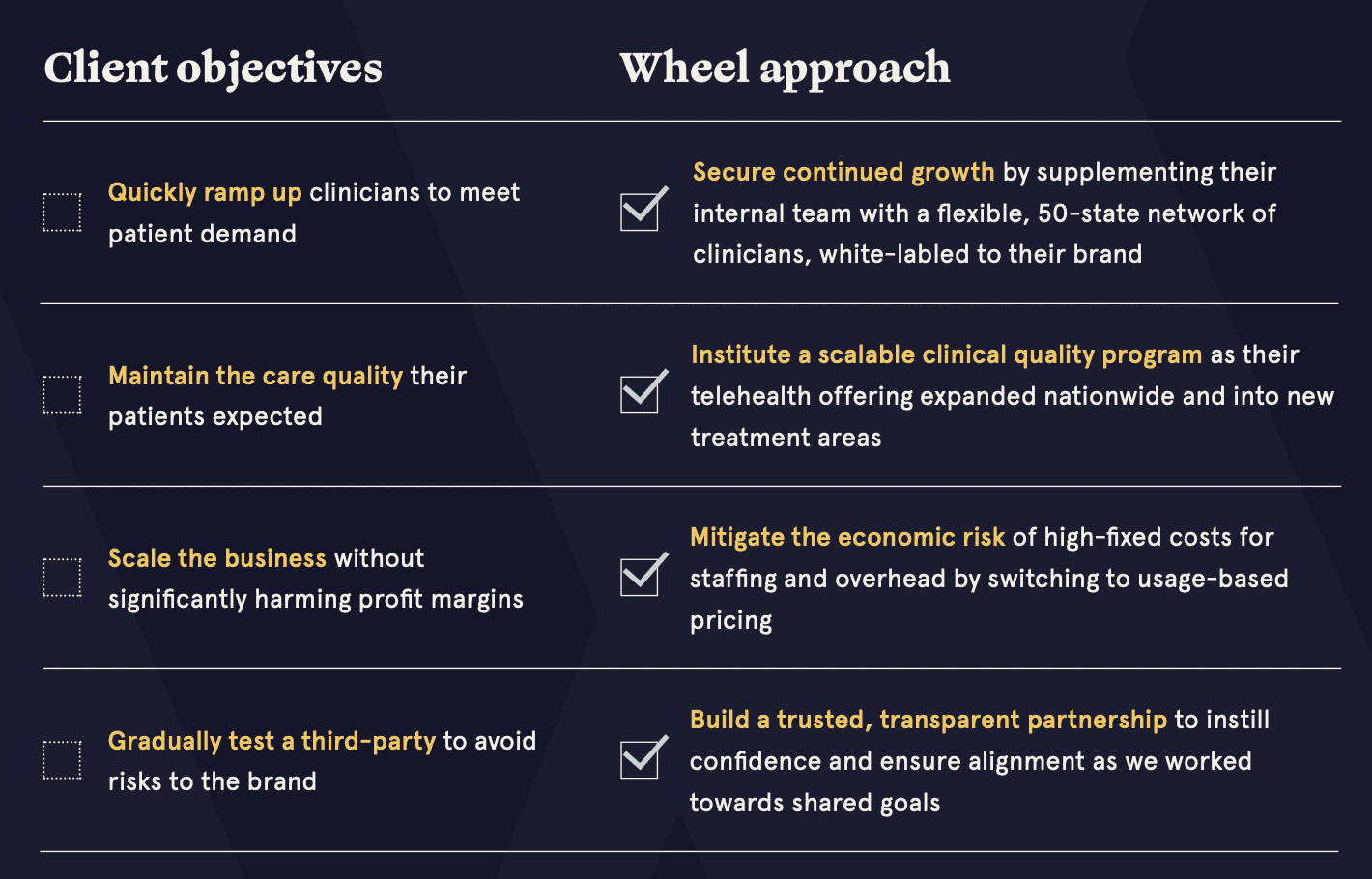

A digital pharmacy company came to Wheel with a highly-regarded service and over 4 million consumers on their platform. With pandemic-induced demand for virtual care, the company quickly expanded with direct-to-consumer urgent and primary care telehealth services.

Launching quickly, they faced challenges in scaling nationwide — growing and managing an internal clinician network became unsustainable and unaffordable. As clinical performance flags increased, the team recognized care quality was beginning to suffer.

To meet growth goals while continuing to service customers, the company needed to augment its clinician network fast — without driving up operational costs or compromising on clinical quality. That’s when they decided to augment with Wheel.

The Solution

Provided a 50-state, white-labeled clinical network to supplement the client's existing workforce

Instituted a scalable clinical quality program with training, guidelines, and monthly clinician workshops

Switched to a usage-based pricing model for economic savings

Offered flexibility to responsibly test the clinical network and scale over time

The Results

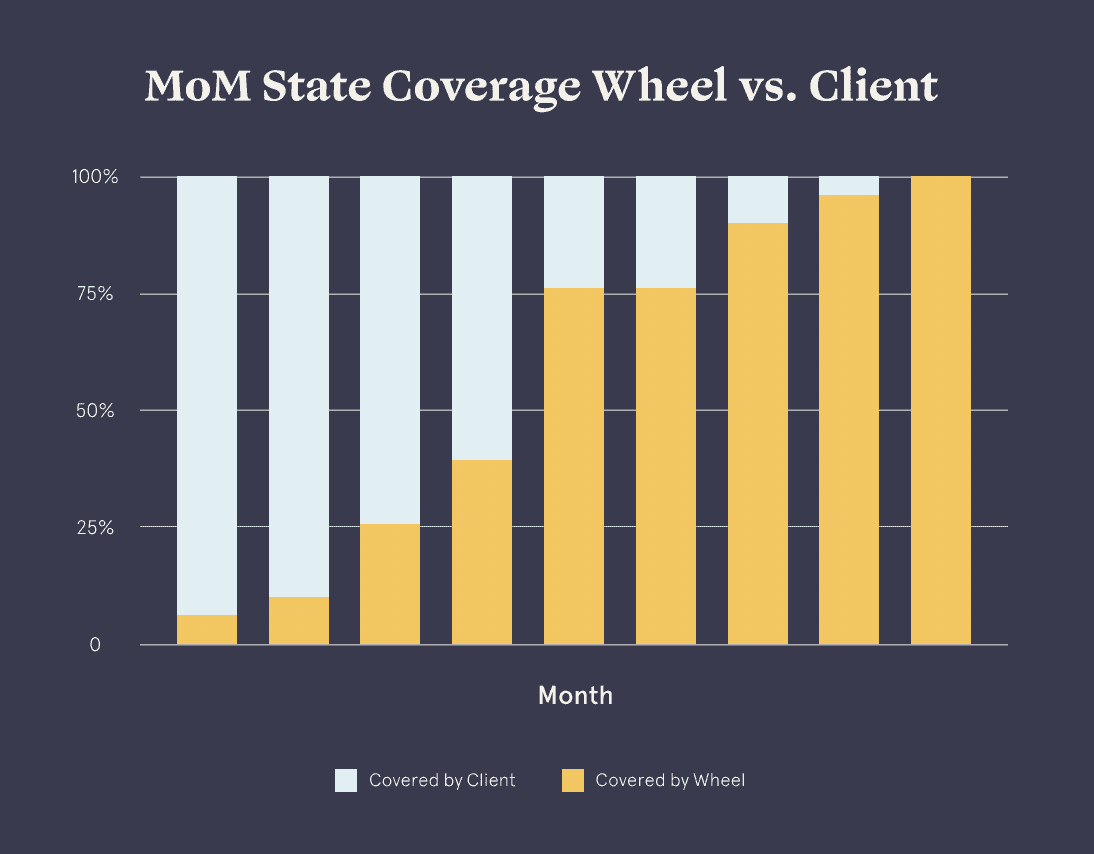

Wheel delivered business impact within the first month of service. At launch, the company was able to rapidly meet increased patient demand in challenging coverage areas and reduce wait times. As the Wheel team continued to meet SLAs and consistently deliver quality care, the client gained confidence in outsourcing their clinical services.

Over 9 months, the company transitioned 100% of its existing clinical network and quality assurance program to Wheel — realizing a 67% savings in clinical staffing and overhead costs.

Not only did this partner maintain standards of care by outsourcing their QA program, but they also reduced performance flag rates by 82%, improving overall clinical quality

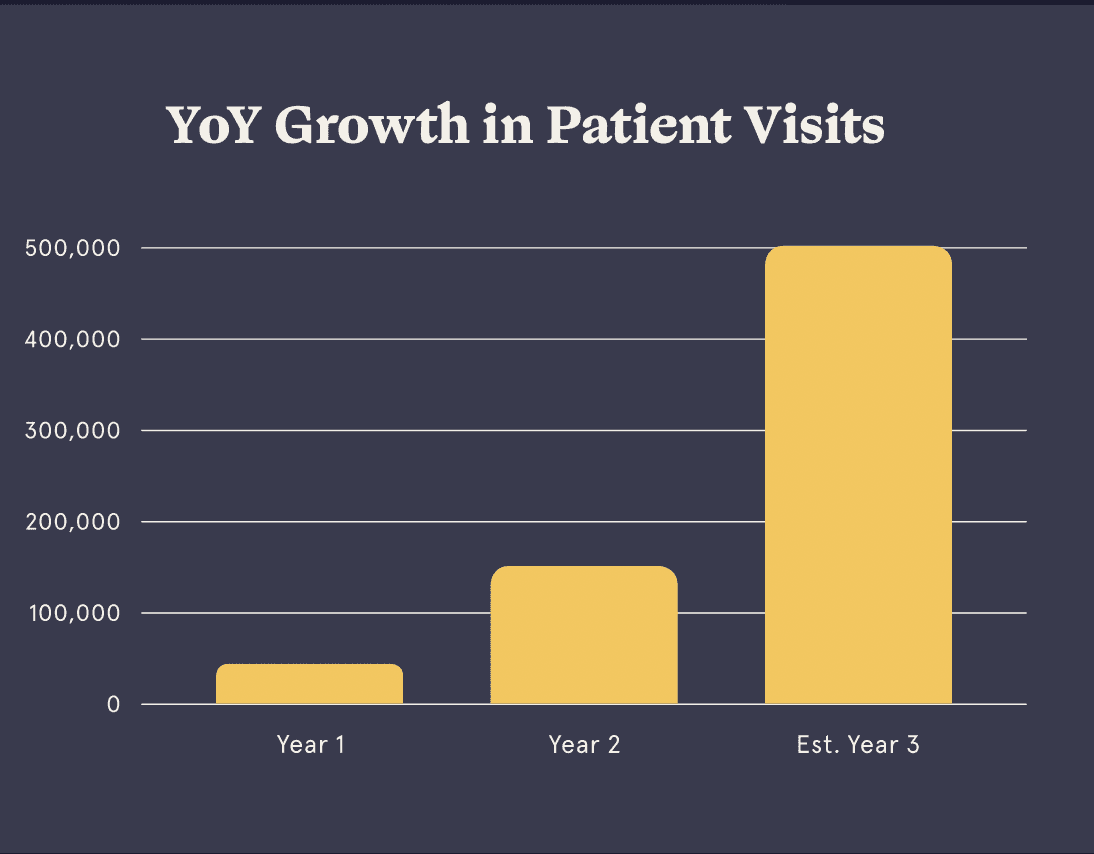

With newfound capital, the company expanded into 10 new treatment areas and invested in patient acquisition efforts to grow visit volume 5x from year one to two and are pacing to reach over 500k visits in year three.

Control Costs in Virtual Care Delivery at Any Scale With Wheel

Don’t let economic uncertainty hold back your business. Wheel helps you reduce operating costs fast – without sacrificing clinical quality and coverage.

Wheel clients save up to 70% in OPEX*

White-labeled care delivered by a proven, 50-state clinician network

Clinical operations and administration management

Virtual care technology and software

Legal and regulatory infrastructure

24/7/365 care coverage and clinician support

Now is the time to ensure your company’s long-term economic stability. Take an innovative approach to reducing spend with Wheel.

Our team is ready to help and can get your company moving in weeks. Contact our team to discuss how to cut OPEX .

*Savings depend on the ratio and volume of care delivered by Wheel.

Further reading: